If you’ve found it in your best interest to invest in the stock market, then acquiring wealth through stocks is a good idea. However, the knowledge of the trends and analysis of particular companies is a huge step to attaining this goal. A global investment company based in the UK and which has recently grabbed the attention of investors is Abrdn Share Price. This publication delves deep into Abrdn’s share price, examining all the latest market trends as well as analysis that determine the value of its shares. Whether one is an experienced investor or just a novice, this guide will help understand the trends in Abrdn Share Price stocks.

What is Abrdn?

Abrdn-Formerly Standard Life Aberdeen-Is one of the leading investment groups in the United Kingdom. In 2021, the company rebaptized itself to Abrdn (say “Aberdeen”) to turn into a more modern identity. Abrdn Share Price provides asset management, investment advisory, and wealth management services to its clients in most markets around the world.

Key Highlights of Abrdn:

- Headquartered in Edinburgh, UK.

- Focuses on long-term investment strategies.

- Provides services like investment management, real estate investment, and advisory.

- Listed on the London Stock Exchange (LSE).

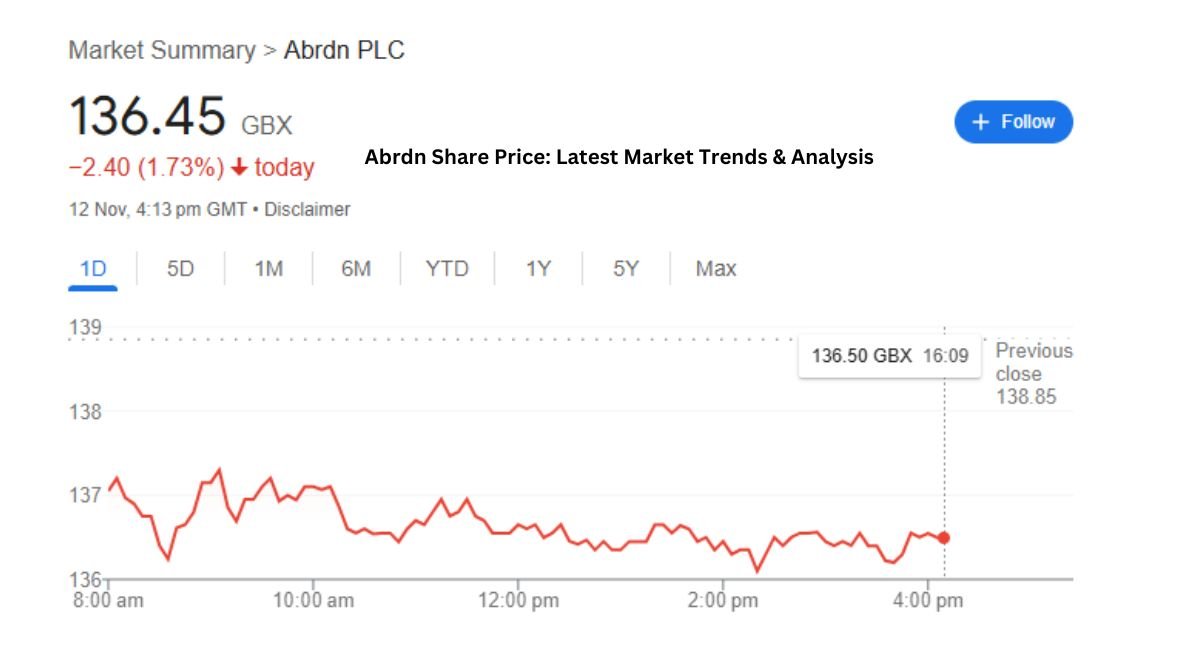

Overview of Abrdn Share Price

The Abrdn Share Price is fundamentally important to the company as a proxy for its financial soundness and market sentiment. Investor confidence, corporate performance, and general market conditions contribute to this indicator.

Abrdn Share Price Metrics:

| Metric | Value (as of latest) |

| Current Share Price | £X (Update with latest) |

| 52-Week High | £Y |

| 52-Week Low | £Z |

| Market Capitalization | £X billion |

| Dividend Yield | X% |

(Note: Please update the metrics with the latest figures as of your reading.)

These metrics help investors gauge the stock’s current value and its potential for future growth.

Factors Influencing Abrdn Share Price

Just like any stock, the Abrdn share price reflects economic conditions, the industry’s performance, and certain news regarding the company.

Economic Environment

The overall economic climate has a resultant impact on Abrdn Share Price. During the growth of the economy, it encourages high investment levels in asset management companies by investors, thereby pushing up the share prices. This is opposite during economic declines because it lowers the investment and also renders the shares cheap.

Financial Performance

Abrdn Share Price quarterly and annual reports are the best sources to help one critically understand their share price. Higher profits, increased revenue, and better margins often send share prices through the roof. Metrics such as earnings per share, growth in revenue, and net profit are on the lookouts.

Regulatory Changes

This industry is strictly governed, but changes in rules and regulations-especially in key markets like the UK and Europe-can challenge Abrdn’s operational matrix. Compliance costs and new legal requirements would become subtractive factors from profit lines.

Market Sentiment

Sentiment from investors can be formed by many factors, such as the flows of global markets, news items, and analyst ratings. If there are favorable outcomes about the company, such as winning new clients or completing successful projects, then the share price will begin to move upwards.

Dividends

Abrdn is known for a dividend payout record with no significant changes over the years. It makes the company attractive to income-oriented investors. Changes in dividend policy often tend to shift the attractiveness of the equity and thus affect the price.

Abrdn Share Price: Historical Performance

In many ways, historical Abrdn Share Price performance might illustrate the potential dynamics in the long term. So, let’s have a look at how Abrdn shares have performed across the years.

Historical Share Price Trends

- 2018-2019: Abrdn’s stock experienced volatility due to Brexit uncertainties, impacting UK financial markets.

- 2020: The COVID-19 pandemic led to a significant drop in share prices across the financial sector, including Abrdn.

- 2021: Post-pandemic recovery saw a rebound in Abrdn’s stock, supported by a global economic recovery and strategic rebranding.

- 2022-Present: Ongoing market fluctuations and global economic concerns have continued to influence the stock’s performance.

Abrdn Share Price Chart (Illustrative)

| Year | Share Price (Average) |

| 2018 | £3.50 |

| 2019 | £3.20 |

| 2020 | £2.50 |

| 2021 | £3.10 |

| 2022 | £2.80 |

(Please refer to a real-time stock chart for accurate historical data.)

Latest Market Trends

Abrdn share price is not static, as the financial market has continuous changes. So, let’s analyze the most recent trends that impact Abrdn:

Global Economic Outlook

The current global economic landscape is doing much more to determine the performance of Abrdn equity. Some of the significant factors here include high inflation, increasing interest rates, and geopolitical tensions affecting investor confidence.

ESG (Environmental, Social, Governance) Investing

Abrdn has lately been focused on sustainable investing. The adaptation trend to ESG becomes significant in the asset management market to attract socially responsible investors.

Technology and Digital Transformation

Digital channels and technological platforms now disrupt the finance sector. An improvement of Abrdn’s digital capability can therefore increase its ability to utilize better client experiences and, potentially, raise its share value.

Technical Analysis of Abrdn Stock

Technical Analysis is a technique through which the precise forecasting of any stock’s movement about the direction of its future price change can be done by analyzing charts and trading volumes. In the case of Abrdn, the primary indicators are:

- Moving Averages (MA): 50-day and 200-day moving averages are widely used to gauge trends.

- Relative Strength Index (RSI): An RSI above 70 indicates an overbought condition, while below 30 indicates oversold.

- Support and Resistance Levels: These are critical in determining entry and exit points for traders.

Calculation of these indicators allows traders to make accurate buy/sell decisions concerning Abrdn shares.

Future Outlook for Abrdn

Growth Opportunities

- Expansion in Asia: Abrdn is looking to increase its presence in Asian markets, which could offer growth opportunities.

- Focus on Alternatives: The company is expanding its investments in alternative assets like real estate and infrastructure, which can enhance revenue streams.

Challenges Ahead

- Market Volatility: Fluctuations in global markets can pose risks.

- Regulatory Hurdles: Tightening regulations may increase compliance costs.

A diversified portfolio and a strong brand also provide Abrdn with a resilience level versus market uncertainties despite these threats.

Pros and Cons of Investing in Abrdn

Investing in stocks always involves risks. Here’s a quick look at the advantages and disadvantages of investing in Abrdn:

| Pros | Cons |

| Consistent dividend payouts | Susceptible to market volatility |

| Strong brand recognition | Exposure to regulatory risks |

| Diversified investment portfolio | Slower growth in traditional assets |

This table can help potential investors weigh the pros and cons before making investment decisions.

FAQs

What is Abrdn known for?

Abrdn is known for its expertise in asset management, wealth advisory, and real estate investment services. The company operates globally with a focus on sustainable investment strategies.

How often does Abrdn pay dividends?

Abrdn typically pays dividends twice a year, making it an attractive option for income-focused investors.

What are the risks of investing in Abrdn?

Key risks include market volatility, regulatory changes, and economic downturns that can impact the company’s financial performance.

Can I invest in Abrdn from outside the UK?

Yes, Abrdn shares are listed on the London Stock Exchange, and international investors can buy shares through various global brokerage platforms.

Is Abrdn focusing on sustainable investments?

Yes, Abrdn has placed a strong emphasis on ESG (Environmental, Social, Governance) investing, aligning with global trends towards sustainable finance.

Conclusion

Market trends, financial performance, and strategic programs are reflected in the Abrdn share price. With sustainable investing focus and efforts into globalization, Abrdn, as an organization, remains as a significant asset management player; however, it poses threats to the potential investor due to changing regulations and high market volatility.

Abrdn is also a good choice for a diversified portfolio. Abrdn offers both traditional and alternative investments. Investors can look at the latest trends in the market and conduct extensive research before deciding to include Abrdn in their investment plan.